As a small business owner or solo business, have you ever been in the position of having to call a client after the appointment has been completed in order to get their credit card details? If so, you’re probably very familiar with how awkward a call like that can feel for you and your client.

That is, if they even answer (leaving a voicemail about it is even more awkward).

If you’ve been self employed for any amount of time, you know that as soon as your appointment is over, clients are way less likely to be responsive. It’s not that they are dodging you. It’s just that you are immediately lower on their priority list. You may not be at the very bottom, but you are far from the top, especially if they know you haven’t secured payment from them yet.

Weirdly, you become a little like a “creepy” debt collector.

Your time is spent calling past clients who suddenly are always busy and unable to take your call. You desperately need to get paid for a backlog of past appointments.

You may even lose out on income by not being able to reach that client – they’ve effectively ‘ghosted’ your business, and after getting such great service from you. They literally fall off the face of the earth and are nowhere to be found.

Relax, I feel your pain. That’s why here at PocketSuite we developed a tool called ‘Complete-and-Charge,’ and it’s revolutionized the way solo businesses and freelancers like you charge clients and run your business.

Not only does it minimize bad debt income by allowing you to charge your client’s card as soon as you complete the appointment, but it also stores your client’s card securely so you can charge them again and again after every future appointment, without ever having to call them for their payment information again.

That’s right – you can store your client’s card details using PocketSuite while remaining fully PCI compliant.

No more shameful, sheepish conversations asking your clients for payment.

Let’s unpack how Complete and Charge has changed the game for businesses and freelancers using PocketSuite. It can do the same for you.

HOW ‘COMPLETE-AND-CHARGE’ IS CHANGING THE GAME

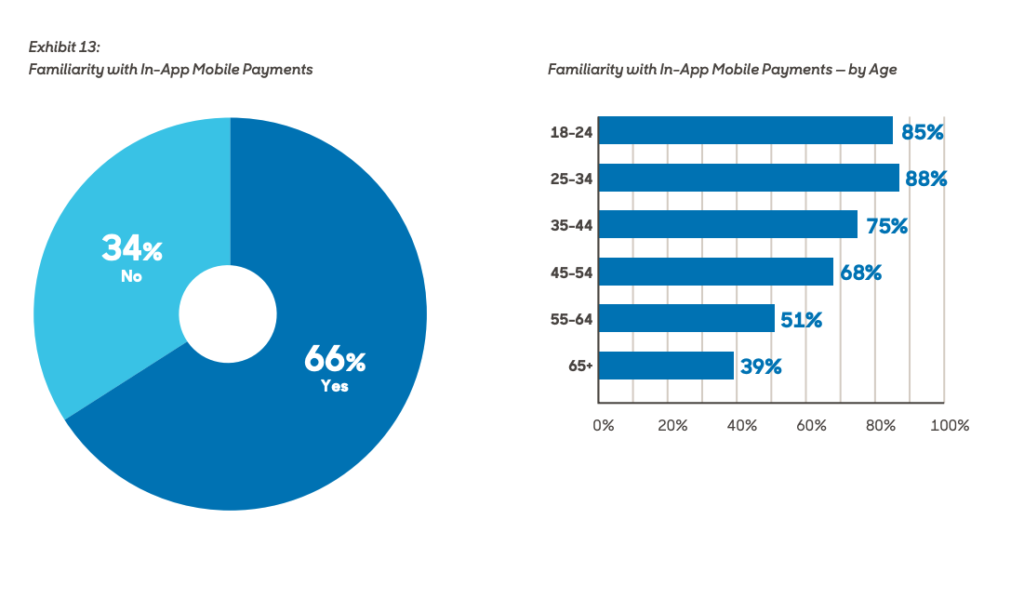

More and more, consumers prefer to pay for everything these days with credit and debit cards.

In fact, a 2017 study by payment processor TSYS found that “fifty-four percent chose debit cards, while 26 percent selected credit cards, and only 14 percent specified a preference for using cash.”

Doing some back-of-the-napkin calculations, that means that a full 80% of consumers (out of a sample size of over 1000) preferred paying with plastic.

That being said, how could you ignore such an important trend by not accepting credit or debit cards for your business? Four out of every five of your potential clients prefer it!

Not only that, but the same study also found that clients are becoming increasingly comfortable with in-app mobile payments – this should further solidify the idea that folks are getting used to paying for things within an app:

Another study done by the SCPC in conjunction with the Federal Reserve Bank of Atlanta found that…

- “In 2017, 12 percent of consumers reported that they did not pay with cash, even once, during the year.”

- “In 2017, one-third of all consumers made a mobile payment, compared with just one-fourth in 2015.”

- “Fewer than 80 percent of consumers who had paper checks on hand reported using them even once in 2017.”

I hope by now you’re sold on the idea that you need to accept credit cards. Fantastic.

Now let’s get down to business…

If you’ve recently come to this conclusion, you’re probably faced with a dilemma – what’s the best way to process these transactions?

In fact, we wrote an entire article on this topic, but today we’ll just be covering how to complete and charge repeat appointments.

The fact of the matter is, for the longest time, small business owners were forced to get in touch with clients after every appointment to book the next appointment and collect payment details for the last appointment.

This, of course, came with a set of challenges – clients wouldn’t answer the phone, business owners would get stressed out, and the vicious cycle would repeat itself over and over again.

However, PocketSuite has made a big contribution to breaking this unhealthy cycle by creating a method of payment called ‘Complete-and-Charge.’

For freelancers and business owners using PocketSuite, long gone are the days of calling pesky clients who can’t seem to have a minute to pick up the phone once you’ve delivered the service to them.

You will no longer feel that dread creeping up on you as the workday approaches its end and you still haven’t called the clients for that day to collect payment.

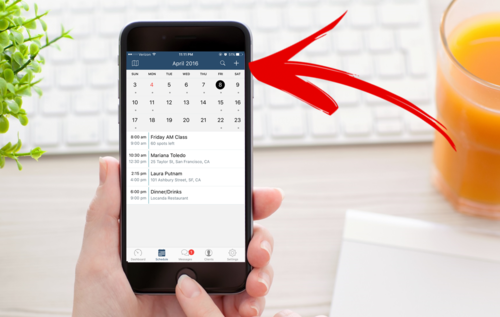

From now on, all you need to do is to with one tap complete the appointments on your calendar for that day.

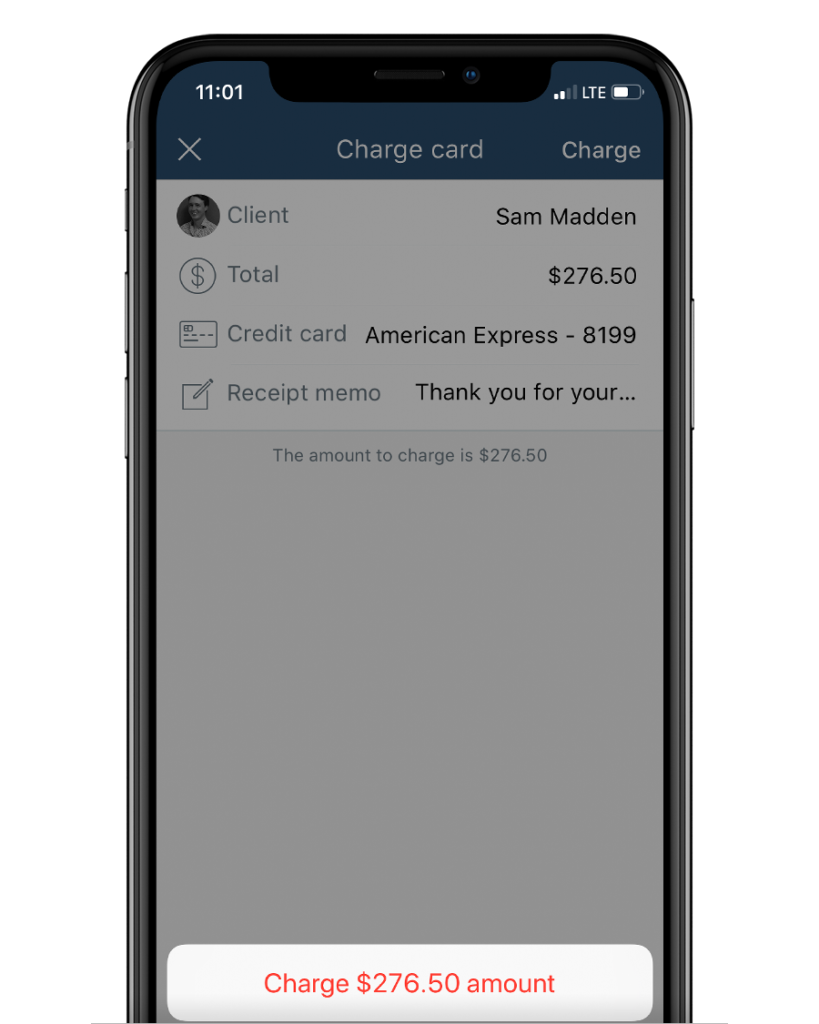

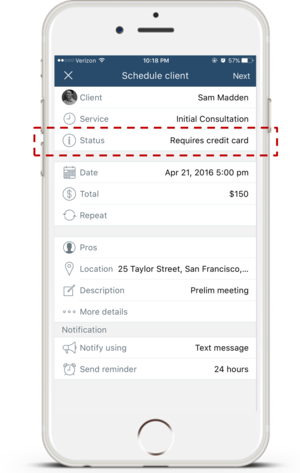

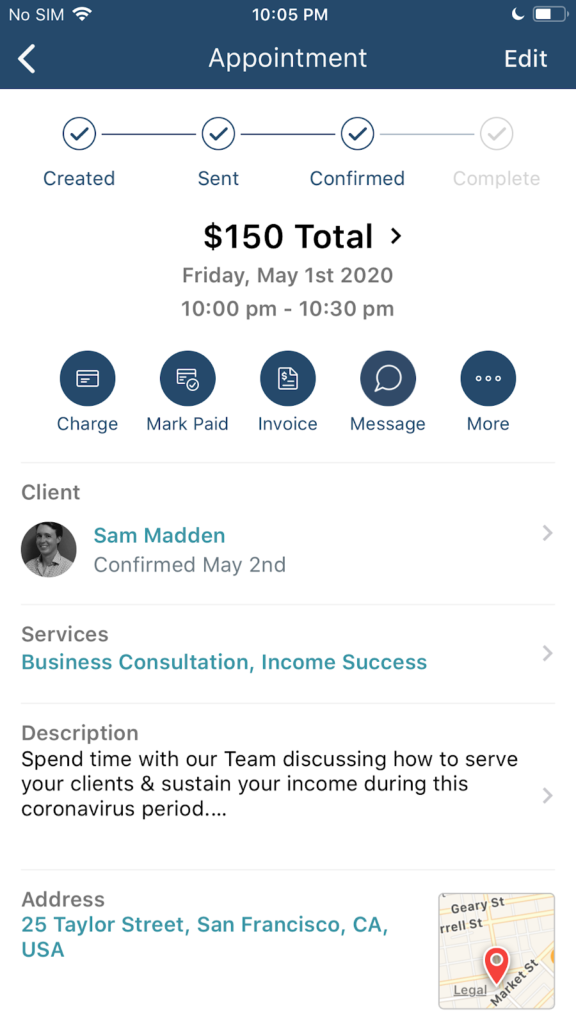

As soon as an appointment is complete, you select the appointment on your calendar and tap ‘Charge,’ which brings up a screen that allows you to modify the total; select the client’s preferred credit card (if they have one on file); and even hand your phone over to them so they can add gratuity (a tip).

This brings an Uber-like convenience to your transactions and eliminates all of the pain and frustration of having to chase down clients for payment.

It’s no wonder that over 50% of payments that occur on PocketSuite are of the ‘Complete-and-Charge’ type.

This is a massively useful and popular feature for a reason.

Say goodbye to outstanding invoices and unpaid bills – you don’t have to be the pushy salesperson that’s calling again and again because you need to get paid to pay your bills.

In fact, you only have to collect your client’s card once and never again.

From then on, the card details are securely stored and fully encrypted within PocketSuite, which means you can keep charging their card after every appointment without having to chase them down or harass them with multiple phone calls.

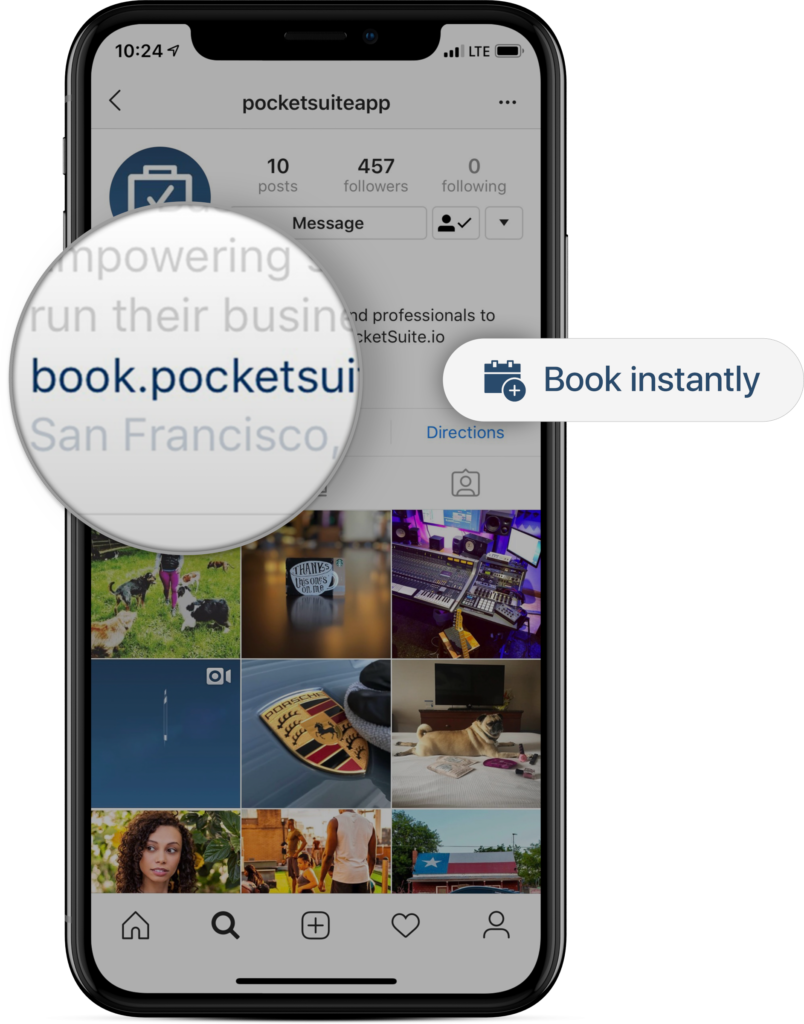

Better yet, using PocketSuite’s handy online booking form (which by the way, you can put on your website, Facebook, Instagram, and email signature) you can have them add their credit card details into your booking link, and eliminate the need for asking for their card details over the phone entirely!

So how exactly does this work on your end?

Once you tap on the appointment (unpaid job) you’d like to charge, it will bring up a screen where you can tap on ‘CHARGE’.

From there, you can add your client’s credit card, accept gratuity (if you like), and process payment.

Check out this video for additional details on how a client experiences booking an appointment with you through PocketSuite.

As a freelancer or business owner, your time is precious, and you should be spending it on the most valuable activities – delighting your clients.

Instead of spending hours chasing down clients, why not invest that time in your Facebook/Instagram marketing, getting more clients, and growing your business?

Let PocketSuite do the heavy lifting by using ‘Complete-and-Charge’ today.

One tiny improvement, all from 1 app, can change the game for you, forever.

There’s even a free plan to get you started, so you have no excuse not to start charging your clients directly after every appointment.

Get ahead of the game and take this advice today. Your future self and healthy business will thank you.

Like this article? You’ll love these articles:

- PocketSuite Appointments

- PocketSuite: 10 ways to accept payments

- Our guide on how to generate leads for service businesses in 2022

- Our Frustrations with Square article